Undoubtedly, trusts are valuable estate planning tools that serve a number of different purposes.

Among the most common are avoiding probate, avoiding guardianship court in the event of incapacity or for minor children, and shielding assets to protect a loved one with special needs.

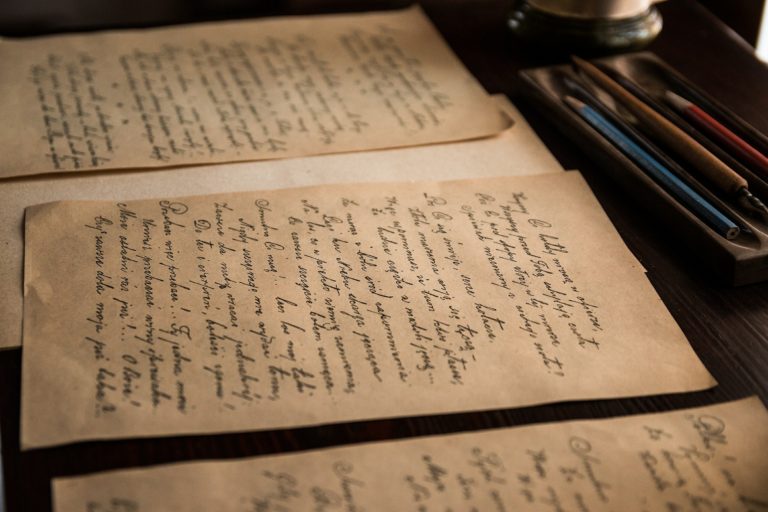

The validity of a Florida trust depends on whether the trust document fulfills the statutory execution requirements.

Creating a Florida Trust – The Essentials

In a trust, the individual creating the arrangement (referred to as trustor or grantor) transfers the nominal ownership of assets to a trustee (fiduciary) for the benefit of one or multiple beneficiaries.

Therefore, the assets held in trust are no longer considered the trustor’s property, as the trust exists as a separate legal entity. Florida trusts fall under two different categories – revocable trusts and irrevocable trusts.

A revocable trust is a trust that can be modified, amended, or even terminated during the lifetime of the trustor. This type of legal arrangement offers flexibility and a greater level of control over the assets held in trust.

In Florida, the trustor of a revocable trust can name him or herself as the trust’s trustee, maintaining control over the assets held in trust while keeping them titled in the name of the trust.

On the other hand, irrevocable trusts are trusts that may not be modified, amended, or terminated. Therefore, unless a court order expressly states otherwise, an irrevocable trust will not accept changes or modifications once it is signed into existence.

In both cases, the validity of the trust depends on specific execution requirements established by Florida law.

Florida Trust Execution Requirements – As Provided by Law

As described by Florida Statutes §736.0403 (1), “a trust not created by will is validly created if the creation of the trust complies with the law of the jurisdiction in which the trust instrument was executed or the law of the jurisdiction in which, at the time of creation, the settlor was domiciled.”

Moreover, Florida Statutes §736.0403 (2)(b) adds that “the testamentary aspects of a revocable trust, executed by a settlor who is a domiciliary of this state at the time of execution, are invalid unless the trust instrument is executed by the settlor with the formalities required for the execution of a will in this state.”

In this context, the term “testamentary aspects” refers to “those provisions of the trust instrument that dispose of the trust property on or after the death of the settlor other than to the settlor’s estate.”

Therefore, the execution requirements of a trust are the same as those applied to wills. In Florida, a valid will must be in writing, receiving the testator’s signature at the end of the document.

If the testator is not physically capable of signing the document, Florida law requires that “the testator’s name must be subscribed at the end of the will by some other person in the testator’s presence and by the testator’s direction.”

Statutory rules require that “the testator’s signing, or acknowledgment that he or she has previously signed the will, or that another person has subscribed the testator’s name to it, must be in the presence of at least two attesting witnesses.”

Additionally, “the attesting witnesses must sign the will in the presence of the testator and in the presence of each other.”

Ensure Full Legal Compliance When Executing a Trust – Immediately Contact Your Florida Probate Lawyer

Waste no time with uncertainty. Call Attorneys Romy B. Jurado and Diana C. Collazos today at (305) 921-0976 or email [email protected] to schedule a consultation.